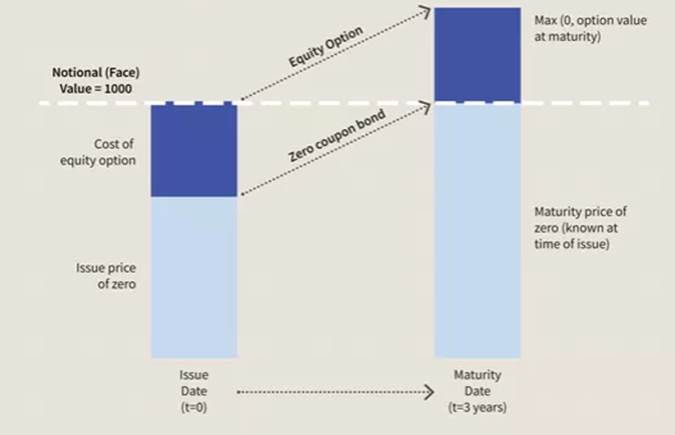

Equity Linked Notes

Equity Linked Notes fall into the Structured Notes product category for which coupon payments are based on the performance of the underlying equity(ies).

The product has a pre-defined schedule according to which the coupons are paid on Payment Date provided that each underlying equity is equal to or greater than the Coupon Barrier status on the Observation Date.

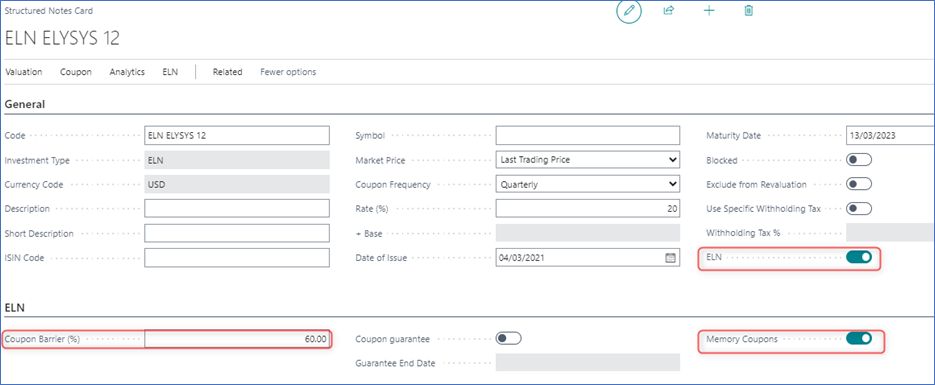

ELN Card

The ELN is created in the Structured Notes Card, and it is activated by enabling the ELN flag.

-

Coupon Barrier (%): specifies the percentage of the Initial Spot Price, on any Observation Date, above which the ELN coupon is paid.

-

Coupon Barrier Spot Price: automatically calculated in the system and located in the ELN underlying page, CBSP = Initial Spot Price x Coupon Barrier (%)

-

Memory Coupon: specifies a coupon that is carried over to the next Coupon Observation Date if the product at a given Observation Date is Below Barrier as defined in the ELN Schedule. However, if payment requirements are met at a certain Observation Date, either the most recent coupon or all coupons that have not previously been paid, will fall due for payment.

-

Coupon Guarantee: a guarantee period in which the coupon is paid even if the barrier is passed.

-

Coupon Guarantee End Date: the date after which coupon will not be paid.

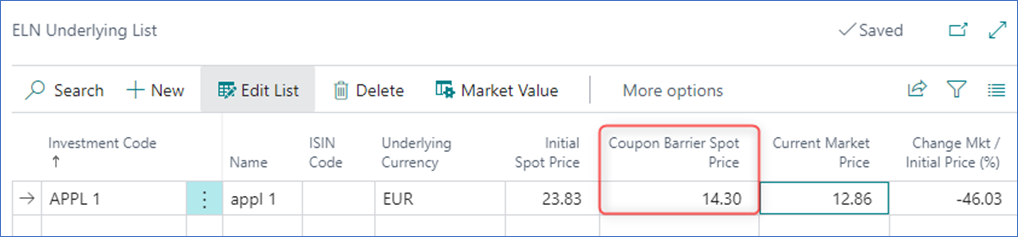

ELN Underlying

Path: Structured Notes Card -> ELN -> ELN Underlying

One or more underlying can be set up for each ELN investment.

Initial Spot Price – specifies the Market Price of the underlying equity at the Date of Issue of the ELN

Coupon Barrier Spot Price = Spot Price x Coupon Barrier %

ISIN Code, Underlying Currency, Current Market Price - Informative fields that are auto-populated.

ELN Payments/Coupon Schedule

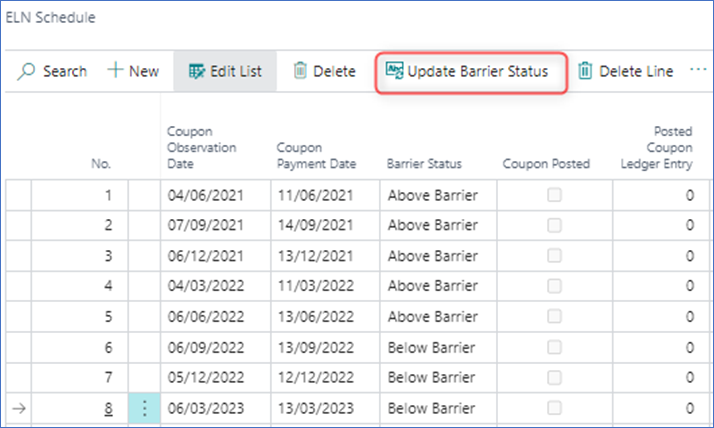

ELN Schedule is partially completed by the user, and it determines if the coupon will be paid based on the Barrier Status.

-

Coupon Observation Date specifies the date on which the Barrier Status is calculated.

-

Coupon Payment Date specifies the date on which the coupon is settled. Coupons are only payable if the Barrier Status is equal to or Above Barrier.

-

Barrier Status: specifies if underlying products are above or below barrier on the Coupon Observation Date.

-

Coupon Posted flag specifies if the coupon is posted. It is unticked if the coupon is reversed.

-

Posted Coupon Ledger Entry field specifies the entry number of the posted coupon.

The Update Barrier Status function recalculates the Barrier Status in accordance with the barrier percentage defined on the card and its underlying market value on the Coupon Observation Date.

Workflow

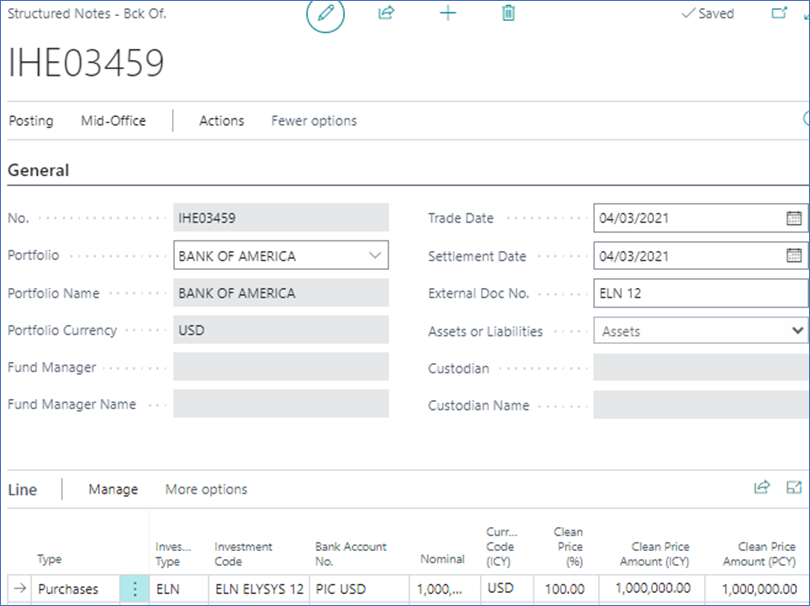

ELN is purchased via the Structured Notes Journal. It can be bought and sold via the Front, Mid and Back Office.

Nominal: specifies the amount invested in the ELN

Clean Price (%): 100%

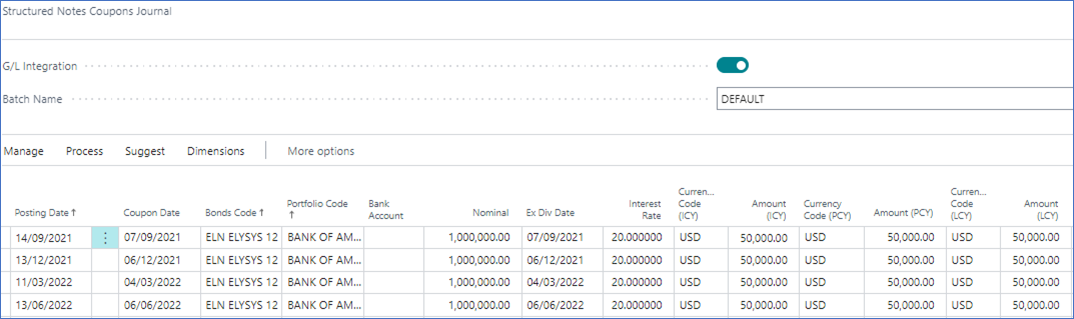

Structured Notes Coupon Journal

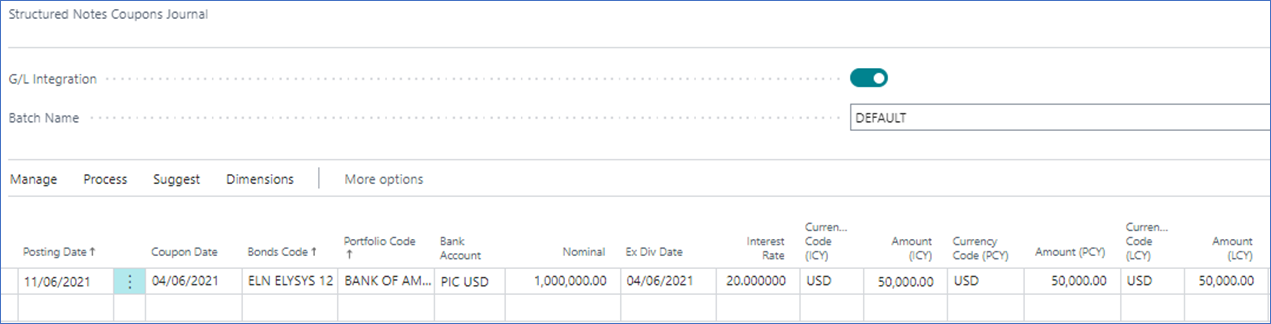

ELN Coupons are suggested and posted via the Structured Notes Coupon Journal

- First Above Barrier coupon payment is suggested at the first Coupon Observation Date on 04/06/2021

Coupon Calculation = Annual Coupon / Number of coupons paid during the

year

Coupon Calculation = Annual Coupon / Number of coupons paid during the

year

Annual Coupon = 200,000.00 = 1,000,000.00 *20% /100

Coupon Frequency = Quarterly

Coupons = 200,000.00 / 4 = 50,000.00

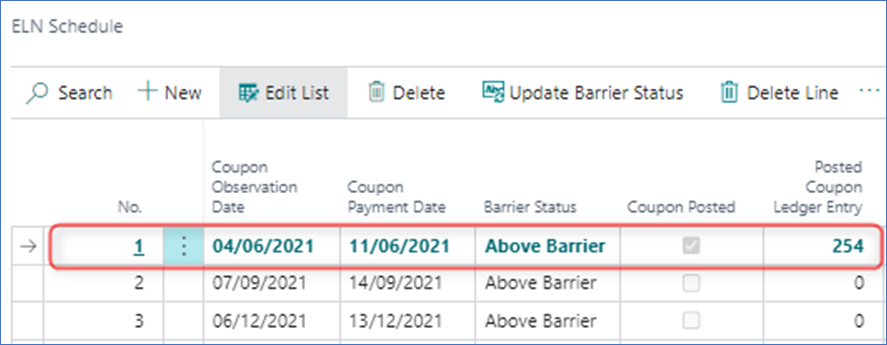

- When the coupon is executed, the Coupon Posted and Posted Coupon Ledger Entry fields in the ELN Schedule are updated.

- In our example, remaining coupons are suggested up until the last Coupon Observation Date on 06/03/2023

The Structure Notes Coupon Journal suggested four lines based on the ELN schedule where the Barrier Status shows Above Barrier entries only until 06/06/2022 with the remaining lines until the Maturity Date being Below Barrier.

Maturity

At the maturity of the ELN, the cash income needs to be executed manually via the Structured Coupon Journal screen, by booking a Sales transaction.